Print buyers are the primary customers of print service providers, and understanding client needs in print communication is essential.

Keypoint Intelligence ran a survey in 2022 targeting European marketers in eight vertical markets, with retail as the largest response demographic. The average respondent’s company had 350 employees, and most had an online/digital marketing duty within their total marketing responsibility. Their average marketing budget was €500,000 (£427,000), with print representing 28% of their budget.

This survey provided helpful insights into how marketers see print within their marketing strategies. For example, while these print buyers expect their overall marketing budgets to grow 7.5% by 2024, their print spend will remain flat. So, we wanted to understand the drivers behind this disconnect and focused on:

- Application trends

- How print compliments e-channels

- Perceived benefits and challenges of customised print marketing

- The demand for specialty printing and the all-important price factor

This article provides an overview of some of our findings.

Application trends

Marketers expect specific applications such as direct mail and catalogs to grow 5% and 3% respectively, while brochures and newsletters are expected to be flat. This opinion is interesting since these same respondents expected the overall print market to be flat. We see a disconnect and believe that the generic perception of print moving forward is worse than reality.

Digital printing vs. offset

The print buyers surveyed had strong opinions regarding the most common run lengths for some main printing applications to see the digital printing opportunity and the potential transition from offset to digital. Most run lengths in this study could be in the crossover point between offset and digital.

- Direct mail: 7,000 pieces

- Brochures: 5,000 pieces

- 44-page catalogues: 1,300 pieces

Print complementing e-channels

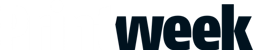

Another opportunity for print could be omnichannel campaigns, but unfortunately, even though most brands plan to include print in their omnichannel campaigns, the print share will be only 27%. Print service providers must still convince marketers about print’s power as a robust and relevant communication channel and that they are excellent partners to complement their e-communication campaigns.

How much of your omnichannel campaigns are you expecting to use print in the next 3 years?

Print marketing customisation

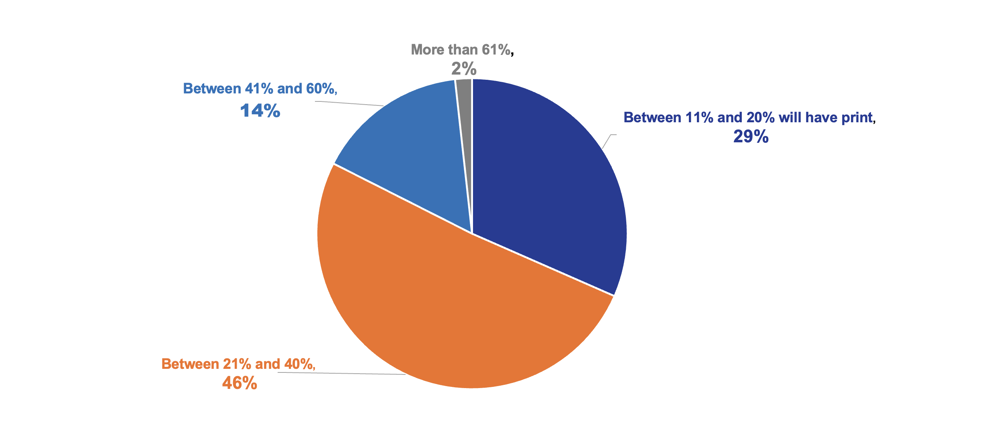

Customisation, which is the oldest, most holistic and natural way of communicating, has been available to printing applications for decades however, there is low usage from print buyers (25%) beyond basic name and address versioning. One of the reasons identified by respondents as the key challenge of adopting higher levels of personalisation is ROI, as shown in the graph below.

What are your main challenges/obstacles when doing customised printing campaigns beyond name and address?

Even though ROI only accounts for 12%, cost and time accounts for a large 60% which indirectly also relates to ROI as if marketers will be successful with their customised campaigns logic suggests they would not mind to invest the extra time and money.

The challenge of customisation does not relate to print or its technologies, it is 100% strategic. Marketers need to have the right strategy including consumer data appropriately organised to increase their chances of being more relevant and getting their required ROIs.

Specialty printing and the price factor

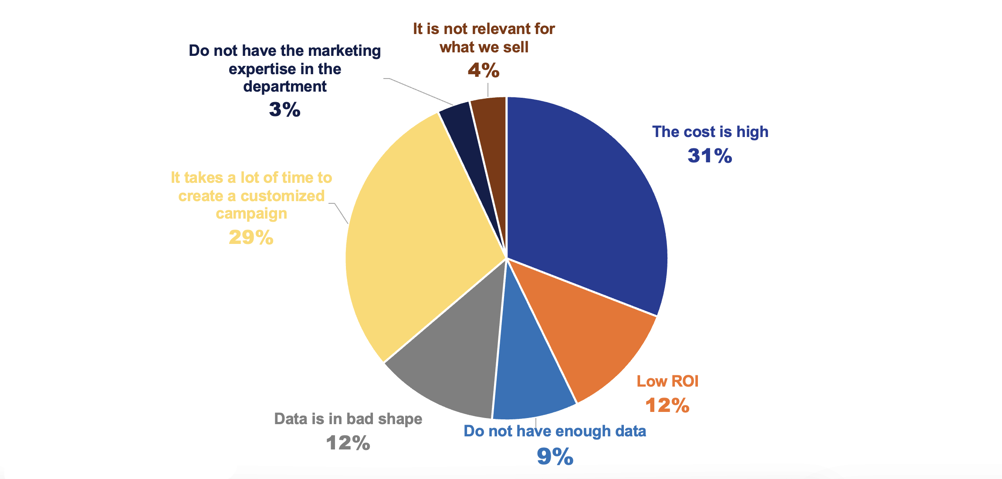

Other specialty printing products besides variable data printing can also play an influential role in helping marketers communicate better. 95% of marketers embrace the value of specialty products such as QR codes, augmented reality (AR), NFC tags, unique designs, papers, finishing and colour embellishments.

What are the top three specialty printing products that you will be interested in purchasing in the next two years?

Print is perceived as a commodity by many with price as a significant criterion. However, our research proved that price is not everything, as 95% of marketers were interested in specialty printing and, therefore, desire products that cost more than basic print materials. Thus, while price seems to be the most relevant criterion for many print marketing campaigns, its importance will depend on the marketers’ target audiences and what they need to communicate and achieve.

As all campaign marketing decisions should be driven by objectives and goals, marketers often might need to spend more to hit such objectives and goals.

German Sacristan is the group director of the Production Print & Media Group. In his role, Sacristan supervises five different production practices (labels & packaging, wide-format, textile & apparel, production workflow and customer communications) while also serving as the principal analyst of the On Demand Printing & Publishing practice.

About Keypoint Intelligence

Keypoint Intelligence is the global data and market intelligence leader for the digital imaging industry. It us the authoritative provider of test based analytical information, competitive intelligence and sales enablement to the digital imaging industry. Its portfolio of products and services covers hardware, software, consumables and document management. Along with providing clients access to a range of SaaS tools and platforms, it offers the most comprehensive independent research and data in the industry.

To discover how Keypoint Intelligence can support your objectives through business, market and technology research and insights, visit keypointintelligence.com